BTC Price Prediction: Path to $200,000 Amid Institutional Frenzy and Supply Squeeze

#BTC

- Technical Breakout Potential: BTC trading above key moving averages with Bollinger Band support indicates strong upward momentum foundation

- Institutional Accumulation Acceleration: Major corporate purchases and scarcity indicators signaling supply squeeze and sustained demand pressure

- Macroeconomic Tailwinds: Federal Reserve rate cut expectations and institutional adoption initiatives creating favorable market conditions for continued appreciation

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

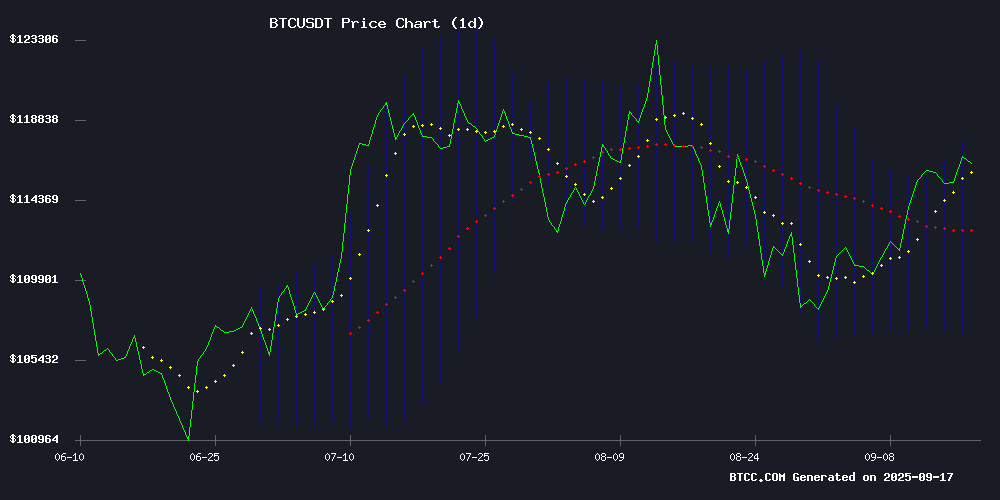

Bitcoin is currently trading at $116,716.59, firmly above its 20-day moving average of $112,473.23, indicating sustained bullish momentum. The MACD reading of -2,589.65 suggests some near-term consolidation, but the price position above the middle Bollinger Band at $112,473.23 shows underlying strength. According to BTCC financial analyst William, 'The current technical setup suggests BTC is building a solid foundation for potential upward movement, with the upper Bollinger Band at $118,190.76 serving as immediate resistance.'

Market Sentiment: Institutional Accumulation and Macro Tailwinds Support BTC Rally

Positive market sentiment is being driven by multiple catalysts including MicroStrategy's accelerated Bitcoin accumulation, Metaplanet's $1.25 billion purchase, and the Bitcoin Scarcity Index turning positive. BTCC financial analyst William notes, 'The combination of institutional adoption, supply squeeze indicators, and macroeconomic factors including potential Fed rate cuts creates a favorable environment for Bitcoin's continued appreciation. The formation of a Treasury Council to push corporate adoption further validates the institutional narrative.'

Factors Influencing BTC's Price

Bitcoin Scarcity Index Turns Positive, Signaling Supply Squeeze

Bitcoin's supply dynamics show signs of tightening as the Scarcity Index registers its first spike since June 2025. The cryptocurrency briefly touched $116,689 over the weekend before settling at $114,000, but underlying market mechanics suggest accumulating pressure.

Binance data reveals a sharp contraction in available BTC supply relative to buy-side demand. The Scarcity Index, which measures this equilibrium, flashed its most significant movement in months. 'When whales enter, liquidity vanishes,' observed Arab Chain of CryptoQuant, noting either substantial exchange withdrawals or canceled sell orders as likely catalysts.

This metric historically precedes price inflection points. The current divergence between spot prices and supply constraints mirrors patterns seen before major rallies, with institutional accumulation often the invisible hand reshaping market structure.

MicroStrategy Accelerates Bitcoin Accumulation Amid Market Optimism

MicroStrategy has completed its 28th Bitcoin purchase this year, outpacing last year's acquisition rate by 58%. The company's aggressive strategy signals a broader move expected in Q4 2025, with analysts projecting nearly 40 BTC purchases by year-end.

Despite a 120% stock decline from its peak, MicroStrategy's Bitcoin treasury now stands at 638,460 BTC, valued at over $46 billion. The firm's cost basis of $72,350 per coin leaves it with approximately $27 billion in unrealized gains.

Market conditions appear favorable for continued accumulation. The Nasdaq Composite's 15% year-to-date surge, driven by rate-cut expectations, creates a supportive backdrop for MicroStrategy's strategy. Last year's 358% return on Bitcoin investments—fueled by 17 purchases—demonstrates the potential upside of this approach.

Metaplanet's $1.25B Bitcoin Purchase Could Catalyze BTC Breakout

Bitcoin's consolidation near $115,000 may soon give way to volatility as Tokyo-based Metaplanet Inc. prepares to deploy ¥212.9 billion ($1.44 billion) from its recent capital raise into cryptocurrency markets. The firm has earmarked $1.25 billion specifically for BTC purchases, with settlement expected imminently.

As Japan's second-largest corporate Bitcoin holder with over 20,000 BTC, Metaplanet's aggressive accumulation strategy reflects growing institutional adoption as a hedge against yen weakness. The capital raise involved issuing 385 million shares at a 9.9% discount, demonstrating shareholder willingness to absorb dilution for crypto exposure.

Given Bitcoin's daily trading volume exceeding tens of billions, Metaplanet's targeted deployment could disproportionately impact order books. Strategic execution may accelerate tests of key resistance levels that typically require extended accumulation periods under ordinary market conditions.

Bitcoin Targets $126K Breakout Amid Fed Rate Cut Concerns

Bitcoin has established key support levels after bouncing from the $111,000 zone, now testing resistance between $116,000 and $118,000. The 0.618 Fibonacci retracement level at $115,429 is acting as critical support, with the 20-day and 50-day EMAs providing additional stability. A breakout above $116,000 could propel BTC toward $123,600, while failure to clear this resistance may trigger a short-term pullback.

Market participants are bracing for volatility as the Federal Reserve prepares to cut rates amid 3.1% inflation and 4.3% unemployment. Historical patterns suggest such cuts often trigger brief sell-offs before recovery. Analysts warn Bitcoin could dip to $104,000—or even $92,000 to fill a CME futures gap—before resuming its upward trajectory.

For Bitcoin Traders, Is a Fed Rate Cut Already Priced In?

Markets are bracing for a near-certain Federal Reserve rate cut, with CME's FedWatch tool showing a 96% probability of a quarter-point reduction. Bitcoin's recent rally suggests the move may already be factored in, leaving traders focused on Jerome Powell's post-announcement commentary for fresh market signals.

The cryptocurrency's price action this week—briefly touching monthly highs—reflects typical low-rate environment behavior. Yet Bitwise strategist Juan Leon cautions that the actual decision may prove anticlimactic: "Where it gets interesting is what Powell says afterwards—that's where you'll see crypto markets flatten out or rally."

Bitcoin Rally to Extend Through 2026 Amid Macroeconomic Tailwinds

Bitcoin's recent surge past $116,000—before stabilizing near $115,000—has sparked debate among traders about the sustainability of its upward trajectory. Arthur Hayes, BitMEX co-founder and Maelstrom CIO, argues the rally is far from exhausted. "Short-term price movements distract from the larger narrative," Hayes asserts, pointing to expansive monetary policies and geopolitical shifts as catalysts for continued appreciation through 2026.

Hayes dismisses rigid four-year cycle theories, emphasizing liquidity conditions over calendar-based predictions. Central banks remain hesitant to tighten policies despite inflationary pressures, with the Federal Reserve and European Central Bank maintaining accommodative stances. "When governments face existential threats—from economic instability to geopolitical fragmentation—they print," Hayes observes. "That liquidity has to find a home."

The upcoming U.S. political transition adds another layer of complexity. With fiscal stimulus likely to accelerate under a new administration in 2025, macro conditions appear aligned for sustained crypto demand. Hayes' analysis suggests Bitcoin's volatility reflects not exhaustion, but the market's gradual recognition of these structural drivers.

Bitcoin Scarcity Index Surges After Price Hits $116K, Signaling Accumulation Ahead

Bitcoin's price briefly touched $116,689 on September 15 before retracing slightly, according to Binance data. During this rally, the Bitcoin Scarcity Index recorded its first upward movement since June 2025—a potential indicator of institutional accumulation.

The Scarcity Index measures available Bitcoin supply against market demand. When exchange reserves shrink amid sustained buying pressure, the index rises. A rapid decline following such spikes often precedes corrections, suggesting speculative trading or liquidations may be at play.

Market analysts note increased volatility likelihood in coming weeks despite recent gains. The current scarcity pulse mirrors patterns observed during previous accumulation phases, where reduced exchange inventories preceded extended bullish trends.

Bitcoin Eyes $117,200 Resistance as Institutional Interest Grows

Bitcoin consolidates near $113,500 support ahead of the Federal Reserve's policy decision, with a potential breakout targeting the $117,200 resistance level. The cryptocurrency currently trades at $115,120, showing a 0.49% gain in the past 24 hours amid cautious market sentiment.

BlackRock's acquisition of 2,270 BTC worth $262.7 million signals strengthening institutional confidence in Bitcoin as a long-term store of value. This move follows a pattern of growing participation from major financial players, even as retail investors remain hesitant.

Market analysts note that Bitcoin's trajectory hinges on its ability to maintain current support levels or break through key resistance. The Fed's upcoming policy announcement could serve as a catalyst for either movement.

Bitcoin Illiquid Supply May Reach 8.3M by 2032: Fidelity Report

Bitcoin's illiquid supply could surge to 8.3 million BTC by 2032, representing nearly 42% of its circulating supply, according to a Fidelity report. Long-term holders and corporate treasuries are driving this trend, locking away coins and reducing market liquidity.

Wallets inactive for at least seven years now control a growing share of Bitcoin's supply. Fidelity projects these holders will accumulate over six million BTC by 2025—more than 28% of the total supply. This structural shift may exacerbate price volatility during demand fluctuations.

Publicly traded companies further tighten supply, with 105 firms holding at least 1,000 BTC each. Their combined holdings exceed 969,000 BTC, or 4.61% of the total supply. 'When scarcity meets institutional demand, the math becomes compelling,' notes the report.

Bitcoin Advocates Form ‘Treasury Council’ to Push Corporate Adoption in Congress

A coalition of corporate Bitcoin holders unveiled the Treasury Council on September 16, positioning itself as a lobbying force for federal BTC adoption. The council comprises nine CEOs from companies with significant BTC treasury holdings, including Strategy CEO Phong Le, MARA Chairman Fred Thiel, and Riot CEO Jason Les.

The group sent a formal letter to congressional leadership endorsing the BITCOIN Act, coinciding with a Capitol Hill advocacy push. Over a dozen crypto advocates met with lawmakers to discuss establishing a Strategic Bitcoin Reserve—a coordinated effort sponsored by The Digital Chamber, Digital Power Network, and the Treasury Council.

Executive Director Merris Badcock framed the coalition as "an exclusive leadership body" bridging corporate strategy and policymaking. The initiative reflects growing institutional confidence in Bitcoin treasury strategies, with member firms like Strategy holding over 440,000 BTC collectively.

Bitcoin (BTC) 2025 Explosive Boom: Pre-FOMC

Bitcoin's price oscillates near $115,000 as market participants brace for the Federal Open Market Committee meeting. Gold's rally to record highs above $3,700 has set a cautious tone, with traders noting its historical lead over cryptocurrency movements.

Liquidity blocks on exchange order books and heightened leverage suggest mounting uncertainty. A critical long liquidation cluster at $114,724.3 threatens to amplify volatility if triggered.

Market sentiment appears top-heavy, with traders increasingly positioning for shorts ahead of the anticipated 0.25% rate cut. The prevailing caution reflects in Bitcoin's tight trading range between $114,800 and $115,300.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 is a realistic possibility within the current market cycle. The technical setup shows BTC trading above key moving averages with strong institutional accumulation patterns. Fundamental factors including the Bitcoin Scarcity Index turning positive, corporate treasury adoption accelerating, and macroeconomic tailwinds from potential Fed rate cuts create a compelling bullish case.

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $116,716.59 vs $112,473.23 | Price above MA = Bullish |

| Bollinger Band Position | Above Middle Band | Upward Momentum |

| Institutional Activity | MicroStrategy, Metaplanet $1.25B | Strong Accumulation |

| Scarcity Index | Positive | Supply Squeeze |

BTCC financial analyst William states, 'The convergence of technical strength and fundamental catalysts suggests the $200,000 target is achievable, though market participants should monitor Fed policy decisions and institutional flow patterns for confirmation.'